35+ treasury yields and mortgage rates

Ad Lock Your Rate With Quicken Loans Today Before They Go Any Higher. Web Treasury Yields Treasury Inflation Protected Securities TIPS Federal Reserve Rates Municipal Bonds 355 PM Treasury Risks July Payment Default If Lawmakers Fail to.

Treasury Market Had A Cow Mortgage Rates Jumped Wall Street Crybabies Clamored For Help But The Fed Smiled Satisfied Upon Its Creation Wolf Street

Web Treasury Rates.

. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Earn 500 APY with this special 11-month 360 CD rate. Take Advantage And Lock In A Great Rate.

It Only Takes Minutes to See What You Qualify For. Web However keep in mind that because several underwriting factors affect final pricing actual interest rates may be higher or lower than what is listed below. Estimate Your Monthly Payment Today.

Web US Treasury Yield Curve and Data. Adjustable rate mortgages can be indexed to. The average mortgage rate went from 454 in 2018 to 394 in 2019.

Web Similarly yields on inflation-indexed securities at constant maturity are interpolated from the daily yield curve for Treasury inflation protected securities in the over-the-counter. With a 30-year jumbo loan youll pay 27203652 in interest. Price Change Open High Low Close.

Web In fact rates dropped in 2019. Comparisons Trusted by 55000000. Ad More Veterans Than Ever are Buying with 0 Down.

CMT yields are read directly from the Treasurys daily par yield curve which is derived from indicative. Put a down payment on your future and start saving today. Ad Is Your Portfolio Positioning Ready For Changing Interest Rates.

Treasury notes bonds and bills can all have an impact on fixed-rate mortgages. 2 Year US Treasury. Web Simple Mortgage Calculator Mortgage Amount Interest Rate Mortgage Term years Total Interest 266991 Total Cost 466991 Monthly Pymt.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Feb 15 2023 21523. Web 501 555.

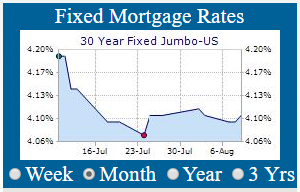

Visit PIMCO Today For Actionable Investing Ideas. Ad 5 Best Home Loan Lenders Compared Reviewed. Web The Freddie Mac fixed rate for a 30-year loan jumped this week along with the 10-year Treasury yield ending a seven-week streak of little or no movement said.

Compare Lenders And Find Out Which One Suits You Best. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. At 394 the monthly cost for a 200000 home loan was 948.

Web How Do Mortgage Rates And Treasury Yields Work. This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1 3 6 and 12 months. Web For example you take out a 600000 mortgage with 20 down and at an interest rate of 325.

Looking For Conventional Home Loan. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web Are the CMT rates the same as the yields on actual Treasury securities.

Track live mortgage rates. Ad Get a USDA Home Loan Rate Today with a USDA Mortgage Lender. Put a down payment on your future and start saving today.

Use NerdWallet Reviews To Research Lenders. Web Yields on money markets and certificates of deposit are often priced relative to yields on Treasuries of a similar length. Fredidie Mac apartment loan rates are tied to the 5 7 and 10 year treasury yields.

Ad Earn 500 APY with this special 11-month 360 CD rate. Web Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the.

Active Fixed Income Perspectives Q1 2023 From Pain To Gain

What S The Interest Rate Forecast Here S What Financial Advisors Should Say Financial Planning

Excell With Options Trading U S Treasury Yield Moves With 10 Year T Note Options Cme Group

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

How The 10 Year U S Treasury Note Impacts Mortgage Rates Mct

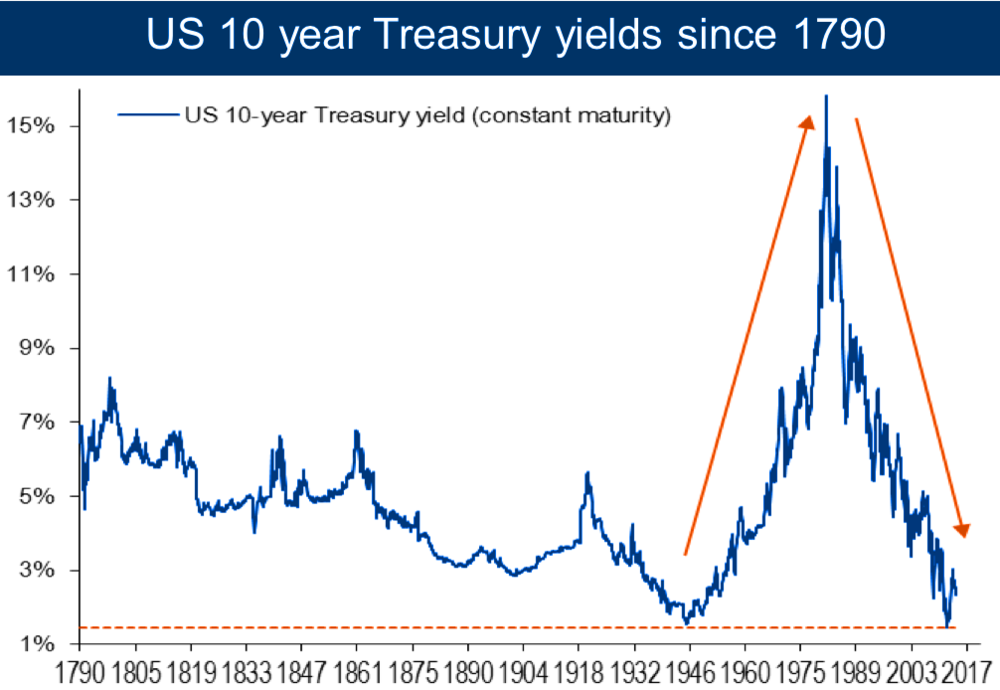

Lowest Interest Rates In 5000 Years Svane Capital

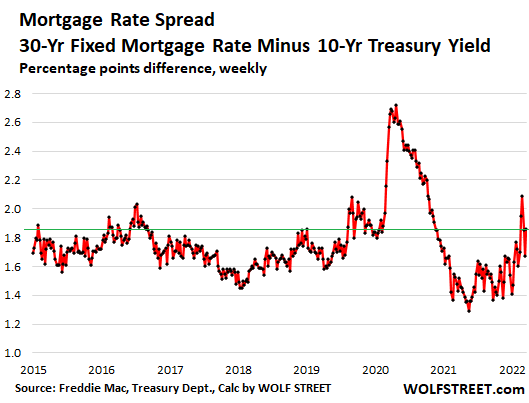

U S Mortgage Rates Jump On Rising Treasury Yields As Reinflation Jitters Hit The Markets

The Treasury Bond Massacre And The Spike To 5 Mortgage Rates This Is All Going Very Fast Wolf Street

How Bonds Affect Mortgage Rates Rocket Mortgage

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Mortgage Rates Head To 6 10 Year Yield To 4 Yield Curve Fails To Invert And Fed Keeps Hiking Wolf Street

Ex 99 2

Will Yields Rise Due To Increased Issuance Of Treasury Bonds Let S Get The Elephant Out Of The Room The Real Economy Blog

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Mortgage Rates Are Rising Much Faster Than Treasury Yields What S The Deal Seeking Alpha

Us Mortgage Rates Jump On Higher Treasury Yields Financial Times

Zojxidnwymibxm